4:49:46

4:49:46  2023-10-17

2023-10-17  1469

1469

1- Pick a savings goal. Saving tends to be easier when you know what you’re saving for. Try to set a goal, such as building an emergency fund, saving for a down payment, saving for a major household purchase, or building a retirement fund. If your bank will let you, you can even give your account a nickname such as “Vacation Fund” to help remind you of what you’re working toward.

2- Keep your savings in a separate account. A savings account is generally the easiest place to put your savings if you are just starting out. If you already have a solid emergency fund and have a reasonable amount to invest, such as $1,000, you may consider something like a certificate of deposit (CD). CDs make your money much harder to get to for a fixed period of time but tend to pay you a higher interest rate.

3- Invest raises and bonuses. If you get a raise, a bonus, a tax refund, or an unexpected windfall, put it in your savings or, if you have one, your retirement account. This is an easy way to help boost your account without compromising your current budget.

4- Dedicate any additional income to your savings. If you work a side gig or if you have any extra sources of income, build a budget based on your primary source of income, and dedicate your other earnings to your savings or retirement account. This will help grow your savings faster while making your budget more comfortable.

Reality Of Islam |

|

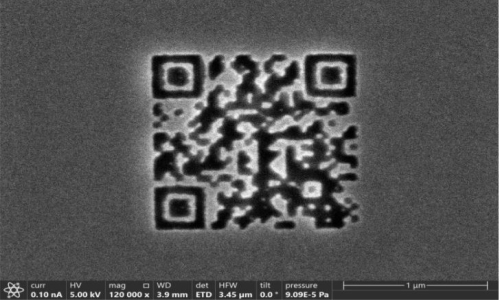

A 1.98-squa

Researchers

A well-know

Scientists

9:3:43

9:3:43

2018-11-05

2018-11-05

10 benefits of Marriage in Islam

7:5:22

7:5:22

2019-04-08

2019-04-08

benefits of reciting surat yunus, hud &

9:45:7

9:45:7

2018-12-24

2018-12-24

advantages & disadvantages of divorce

11:35:12

11:35:12

2018-06-10

2018-06-10

6:0:51

6:0:51

2018-10-16

2018-10-16

6:14:3

6:14:3

2023-01-18

2023-01-18

8:21:9

8:21:9

2018-06-21

2018-06-21

5:58:12

5:58:12

2021-12-18

2021-12-18

3:42:22

3:42:22

2021-12-24

2021-12-24

4:2:19

4:2:19

2022-10-10

2022-10-10

2:42:26

2:42:26

2023-02-02

2023-02-02

2:11:12

2:11:12

2022-10-15

2022-10-15

5:41:46

5:41:46

2023-03-18

2023-03-18

| LATEST |